PPT : Bank Reconciliation Statement | Accountancy Class 11 - Commerce PDF Download

Top courses for commerce, faqs on ppt : bank reconciliation statement - accountancy class 11 - commerce, video lectures, important questions, viva questions, ppt : bank reconciliation statement | accountancy class 11 - commerce, mock tests for examination, previous year questions with solutions, objective type questions, sample paper, shortcuts and tricks, practice quizzes, extra questions, study material, semester notes, past year papers.

PPT : Bank Reconciliation Statement Free PDF Download

Importance of ppt : bank reconciliation statement, ppt : bank reconciliation statement notes, ppt : bank reconciliation statement commerce questions, study ppt : bank reconciliation statement on the app, welcome back, create your account for free.

Forgot Password

Change country.

BANK RECONCILIATION STATEMENT

Jan 05, 2020

330 likes | 549 Views

BANK RECONCILIATION STATEMENT. B.R.S. Dr P S Baliyan. BANK RECONCILIATION STATEMENT. Bank reconciliation is the process of matching and comparing figures from accounting records against those presented on a bank statement.

Share Presentation

- bank reconciliation

- bank statement

- bank account

- bank statement adjustments

- long term savings investments

Presentation Transcript

BANK RECONCILIATION STATEMENT B.R.S Dr P S Baliyan

BANK RECONCILIATION STATEMENT • Bank reconciliation is the process of matching and comparing figures from accounting records against those presented on a bank statement. • Subtract any items which have no relation to the bank statement, the balance of the accounting ledger should reconcile (match) to the balance of the bank statement.

Reasons for difference between these two Balances: • Cheques issued but not presented for payment. • Cheques sent for collection but not collected by the bank. • Credits(deposits) made by bank for interest allowed by the bank. • Payment made by the bank-(insurance premium, bill payables etc. • Collection made by the bank. • Interest charged on bank overdraft by bank.

Reasons for difference... • Any wrong entry on the debit side of the Bank statement. • Cheques paid into bank but omitted to be entered in cash book. • Any wrong entry on the credit side of the Bank statement. • Dishonoured cheques

There are three main forms of accounts in banks….1 • Current account : No interest on deposits. Benefits: Any number of time deposit and with draw the money in a day [ no restrictions on withdrawals] Useful: Business people

There are three main forms of accounts in banks….2 • Savings account : Small rate (%) of interest • Conditions: Few withdrawals in a day up to certain limit. Useful: Employees & small saving habit peoples

There are three main forms of accounts in banks ….3 • Fixed deposit account :Good rate (%) of interest • Condition: No withdrawals up to certain period i.e., 3 ,6 or 1 year etc. • Useful: who plans for long term savings / Investments.

Terms used in banking Standing order: A firm can instruct its bank to pay regular amounts of money at stated dates to persons or other firms. Direct debit: A firm can allow creditors permission to obtain funds directly from the firm’s bank account – which allows the amounts collected to vary.

How to do basic transactions in a Bank • Opening of a bank account • Depositing the money in bank • Withdrawing the money from the bank

Know about cheque : • A cheque must be dated and must include the name of person or organization for which it has to be paid. The amount has to be written in words and figures, and must be signed by account holder. The signature must tally with specimen signature, which is being provided by the account holder while opening the account.

Bank statement or pass book • Banks will either send a periodical bank statement of the account or a give a pass book to the customer. The entries made in the statement or passbook shows the transactions made by the account holder.

Bank reconciliation statemnt Bank Reconciliation Statement as at ***** Balance as per cash book **** Add: Unpresented cheques **** dividend collected by bank **** All direct deposit by customers **** Less:Cheques sent for collection but not yet col Bank charges Bills dishonoured Payments made by bank **** Balance as per bank statement ****

Pay to the order of: ABC Co. Cash • Coin and currency • Checking, savings, and money market accounts • Undeposited, cashier, and certified checks LO1

Readily convertible to cash • Original maturity to investor of three months or less 1 2 3 4 5 6 7 8 9 10 1 2 3 11 12 13 14 15 16 17 4 5 6 7 8 9 10 1 2 3 18 19 20 21 22 23 24 11 12 13 14 15 16 17 4 5 6 7 8 9 10 25 26 27 28 29 30 31 18 19 20 21 22 23 24 11 12 13 14 15 16 17 25 26 27 28 29 30 31 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Cash Equivalents • Commercial paper • U.S. Treasury bills • Certain money market funds

Cash Management • Necessary to ensure company has neither too little nor too much cash on hand • Tools • Cash flows statement • Bank reconciliations • Petty cash funds LO2

Bank Statements Cash balance, beginning of period + = Cash balance, end of period • Canceled cheques • Direct debit • Service charges • Deposits • Customer notes and interest collected by bank • Interest earned

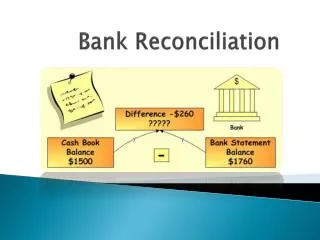

Example of Reconciliation Bank Statement Adjustments Balance per statement, June 30 P3,308.59 Adjusted balance, June 30 P3,233.05 Cash Account Adjustments Balance per books, June 30 P2,895.82 Adjusted balance, June 30 P3,233.05

End of the chapter

- More by User

Bank Reconciliation

Bank Reconciliation. Chapter 4. Objectives. Reconcile your checking Create bank reconciliation reports Find errors during reconciliation Correct errors found during reconciliation Make corrections when QuickBooks automatically adjusts the balance in a bank account

770 views • 17 slides

Bank Reconciliation. Bank Reconciliation. Process of balancing your check book Compare your bank statement to your records in QuickBooks to ensure that bank shows what you have in your accounts Must be done every month for each bank account Any discrepancies must be identified and corrected

1.2k views • 21 slides

Bank Reconciliation. 2014. Topics. Reconciling Bank Accounts Bank Reconciliation Reports Finding Errors During Bank Reconciliation Handling Bounced Checks Reconciling Credit Card Accounts and Paying the Bill Bank Feeds. Reconciling Bank Accounts.

371 views • 0 slides

Bank Reconciliation. ACCN 1 - Accounting. Starter for 10…. Write 3 questions regarding anything topics we have studied so far this year…. Write the answers for the questions……..

450 views • 13 slides

Bank Reconciliation . What is bank reconciliation?. A process that allows individuals to compare their personal bank account records to the bank's records of the individual's account balance in order to uncover any possible differences. Why do these differences happen?.

742 views • 12 slides

BANK RECONCILIATION

BANK RECONCILIATION. Class: XI- Commerce Subject: Principle of Accounting Lecture prepared by: Mrs. Nasreen Lalani Date : 1st October,2011. BANK RECONCILIATION. Transaction. Cash book. Bank Reconciliation. Not recorded. Not recorded. Transposition error . Transposition error .

502 views • 9 slides

Bank Reconciliation Statement

Bank Reconciliation Statement. Prepared by:- Chahat singla . Cash book. Cash book with bank column only. Particulars . Date . Rs . Date. Particulars . Rs . Payments. Receipts. Pass book. Pass book. Receipts. Payments. Defination :-.

1.05k views • 24 slides

Bank Reconciliation. Rearrange the boxes below to go in the correct order of reconciling the accounts Then delete this box. Bank Statement . Book Balance. Equal. Add:. Less:. Add or subtract:. Adjusted book balance. NSF checks. Deposit in transit. EFT receipts.

192 views • 2 slides

Bank Reconciliation. Presented by: Nancy Ross. Bank Reconciliation Selection. Create new – Choose Bank – Update “ending date” Select “Search” button to display data. Select cleared checks and deposits.

552 views • 20 slides

Bank Reconciliation. 1. Introduction. Bank reconciliation statement is a report which compares the bank balance as per company's accounting records with the balance stated in the bank statement The term reconciliation simply means to bring together

1.99k views • 8 slides

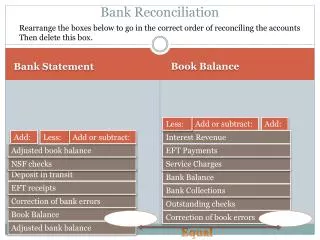

Bank Reconciliation. Rearrange the boxes below to go in the correct order of reconciling the accounts Then delete this box. Bank Statement . Book Balance. Less:. Add or subtract:. Add:. Add:. Less:. Add or subtract:. Interest Revenue. Adjusted book balance. EFT Payments. NSF checks.

253 views • 1 slides

Bank Reconciliation. Bank Reconciliation. Reconcile. Cash Book. Bank Statement. Example. The bank columns of Fatima’s cash book for the month of April 2008 are given below. Cash Book (Banks columns only). Fatima’s bank statement for the month of April 2008 is given below.

504 views • 10 slides

BANK RECONCILIATION. Class: XI- Commerce Subject: Principle of Accounting Lecture prepared by: Mrs. Nasreen Lalani Date : 1st October,2011. BANK RECONCILIATION. Transaction. Cash book. Bank Reconciliation. Not recorded. Not recorded. Transposition error. Transposition error.

694 views • 9 slides

BANK RECONCILIATION. An organisation’s Bank Account balance often differs from the balance shown on the Bank Statement prepared by the bank. Why?. THINGS THE BANK MAY NOT KNOW YET. Cheques paid to creditors who may hold on to them before taking them to the bank days later

392 views • 9 slides

Bank Reconciliation Statement. JOIN KHALID AZIZ. ECONOMICS OF ICMAP, ICAP, MA-ECONOMICS, B.COM. FINANCIAL ACCOUNTING OF ICMAP STAGE 1,3,4 ICAP MODULE B, B.COM, BBA, MBA & PIPFA. COST ACCOUNTING OF ICMAP STAGE 2,3 ICAP MODULE D, BBA, MBA & PIPFA. CONTACT: 0322-3385752 0312-2302870

710 views • 38 slides

Bank Reconciliation. Illustration. Reconcile. Cash Book. Bank Statement. Example 1. Central Industries has the following Cash Book (Bank Columns only) showing a balance of $ 1,565 at the end of February 2007 but its Bank Statement shows a balance of $ 1,735. Example 1.

439 views • 16 slides

Bank Reconciliation Statement. The purpose of the bank reconciliation statement. Due to the timing difference, omissions and errors made by the bank or the firm itself. The balance of the bank statement and the bank account in the cash book rarely agree.

697 views • 35 slides

Bank Reconciliation Statement. Learning Objectives. Explain the functions of a bank reconciliation statement Explain the causes of differences of the balance of the cash book and balance in the bank statement Update cash book Prepare a bank reconciliation statement. Cheques receipt

347 views • 15 slides

Here we have considered the Difference between the Bank balance as per Cash Book & the Pass book by preparation of the Bank Statement. The reasons of differences & importance of finding the variation is discussed.

3.66k views • 23 slides

If you don't have time to solve your business accounting problem then now Lsks account and auditing provides you bank reconciliation service to handle all your case statements issue. And we manage your all detail at one particular point.

222 views • 6 slides

Monthly Bank Reconciliation

Monthly Bank Reconciliation is a procedure of comparing monthly financial transactions of your company’s with the monthly statements of your bank. If you are interested more info related bank reconciliation visit our official website. https://bit.ly/2LowLYl

110 views • 6 slides