Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Investment Company Business Plan

Start your own investment company business plan

Investment Company

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

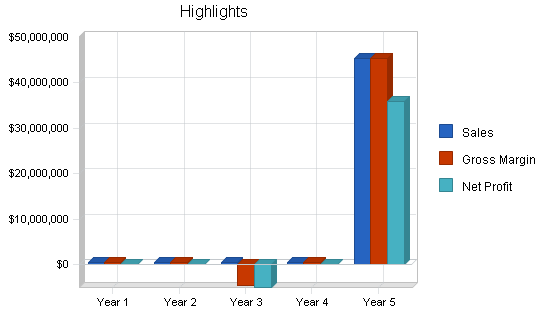

This sample plan was created for a hypothetical investment company that buys other companies as investments. In this sample, the hypothetical Venture Capital firm starts with $20 million as an initial investment fund. In its early months of existence, it invests $5 million each in four companies. It receives a management fee of two percent (2%) of the fund value, paid quarterly. It pays salaries to its partners and other employees, and office expenses, from the management fee.

The investments show up in the Cash Flow table as the purchase of long-term assets, which also puts them into the balance sheet as long-term assets. You can see them in this sample plan, in the first few months.

In the third year, one of the target companies fails, so $5 million is written off as failure. You’ll see how that looks as a $5 million sale of long-term assets in the cash flow, and a balancing entry of $5 million in costs of sales in the profit and loss, making for a loss and write-off that year. The result is a tax loss, and the balance of investments goes to $15 million.

In the fifth year, one of the target companies is transacted at $50 million. You’ll see in the sample how that shows up as a $45 million equity appreciation in the sales forecast, plus a $5 million sale of long-term assets in the cash flow. At that point there’s been a $45 million profit, and the balance of long-term assets goes down to $10 million.

This is a simplified example. The business model holds long-term assets and waits for them to appreciate. It doesn’t show appreciation of assets until they are finally sold, and it doesn’t show write-down of assets until they fail. Sales and cost of sales are the appreciation and write-down of assets, plus the management fees.

The explanation above has been broken down and copied into key topics in the outline that are linked to corresponding tables. These topics are:

- 2.2 Start-up Summary

- 5.5.1 Sales Forecast

- 6.4 Personnel

- 7.4 Projected Profit and Loss

- 7.5 Projected Cash Flow

- 7.6 Projected Balance Sheet

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Content has been omitted from this sample plan topic, and following sub-topics. This sample plan has an abbreviated plan outline. With the exception of the Executive Summary, only those topics linked to key tables have been used.

The focus of this sample plan is to show the financials for this type of company. Brief descriptions can be found in the topics associated with key tables.

2.1 Start-up Summary

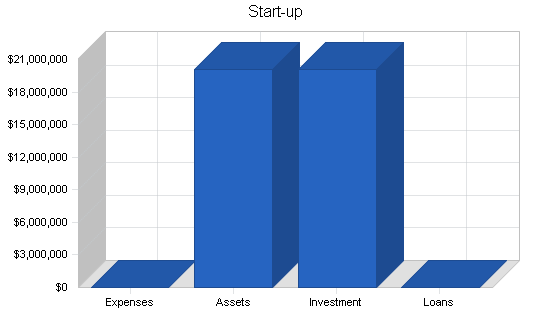

This hypothetical Venture Capital firm starts with $20 million as an initial investment fund. The venture capital partners invest $100,000 as working capital needed to balance the cash flow from quarter to quarter.

Market Analysis Summary how to do a market analysis for your business plan.">

Strategy and implementation summary, sales forecast forecast sales .">.

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

7.1 personnel plan.

This hypothetical company pays salaries to its partners and other employees, and office expenses, from the management fee of two percent (2%).

Financial Plan investor-ready personnel plan .">

8.1 projected profit and loss.

Please note that in the third year one investment is written off as a failure, producing a $5 million cost which ends up showing a loss for the year of nearly $5 million. The sale of equity at the end of the period enters the sales forecast and the profit and loss statement as a $45 million gain.

8.2 Projected Cash Flow

The Cash Flow shows four $5 million investments made in the first few months of the plan.

In the third year, one of the target companies fails, so $5 million is written off as failure. You’ll see that shows as a $5 million sale of long-term assets in the cash flow, and a balancing entry of $5 million in costs of sales in the profit and loss, making for a loss and write-off that year. The result is a tax loss, and the balance of investments goes to $15 Million.

In the fifth year, another investment is transacted at $50 million. This shows up as a $5 million equity appreciation in the Sales Forecast, plus a $5 million sale of long-term assets in the Cash Flow. At that point there’s been a $45 million profit and the balance of long-term assets goes down to $10 million.

The partners invest an additional $100,000 in the fourth year as additional working capital to balance the cash flow of the company.

8.3 Projected Balance Sheet

You can see in the balance sheet how the ending balances for long-term assets were not re-valued. They remain at the original purchase price until they are sold, or written off as a complete loss. There is a $5 million write-off in the third year, and a sale of $5 million worth of assets in the last year. That sale of $5 million in assets produces the $5 million sale at book value plus the $45 million gain in the sales forecast and profit and loss table.

8.4 Business Ratios

The Standard Industry Code (SIC) for this type of business is 7389, Business Services. The Industry Data is provided in the final column of the Ratios table.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to Write a Business Plan For Investors (That They Will Love)

The Startups Team

A good business plan does more than just inform readers about what your company does, how you earn money, or what you want to do. It persuades the reader that your company is awesome, gets them excited about the opportunity to get involved, and makes them want to help you succeed.

But how do you write a good business plan for investors? You probably didn’t go to business school and if you’re a first-time founder, it can be really hard to figure out how to do something so technical. But don’t worry! This guide will walk you through how to write a business plan for investors, will help you answer the most important questions about your business, and will show you the best ways to illustrate them. We’ve also thrown in some additional resources you can turn to for help.

And if that’s still not enough, Bizplan is giving Startups.com readers 50 percent off their first month of business planning services. Check it out here .

The Big Picture

There are 14 important sections of a business plan. But that is by no means an excuse to write out your entire life story on paper. The average business plan should be around 15 pages — no more than 20.

In the past, the average business plan was anywhere from 40 to 100 pages, and guess what they found out? No one was reading all of that. So don’t let important information about your company get lost in a jumble of words. Investors look for founders who can provide the most value in the least amount of time, and your business plan is a great indication of that ability.

The Big Questions

By the time readers are done reading your business plan, they should have a clear understanding of the following: Why (Why this? Why now? Why you? Why them?) and how (How will you make money? How will you get customers? How will you grow your business?).

These questions should be answered throughout your business plan, and should prove to those reading it that your company has the right product, market, team, time, and strategy to make them a return on their investment.

So without further adieu, here is a breakdown of writing a business plan for investors:

1. Executive Summary

The Executive Summary is an introduction to the main ideas that you will discuss in the rest of the plan. If an investor read only the Executive Summary and nothing else, you’d want them to be able to walk away with a clear understanding of the main highlights of your business and why it’s exciting.

A good Executive Summary includes quick, one to two sentence overviews of the following information: mission statement, product/service summary, market opportunity summary, traction summary, next steps, and vision statement.

Pro tip: Although the Executive Summary comes first, it is often helpful to write it last because you’ll have worked through everything by then.

2. Investment Opportunity

The Investment Opportunity section is where you tell investors what your goals are, why they are integral in helping you achieve those goals, and what they have to gain from getting involved with your company. This includes:

- Your Funding Goal : How much money do you need to move forward

- Terms : What will investors get in exchange for their investment?

- Use of Funds : How do you plan to use those funds? (Hint: a 6-figure salary for yourself isn’t what they’re looking for here)

- Milestones : What will you be able to achieve with their investment?

Again, the most important question to answer here is why: Why should investors want to be a part of your company, and why is now the time for them to get involved? Identify the three to four key factors that make your company a great opportunity and make sure they’re included in this section.

3. Team Overview

This is where you introduce your team and how you’ll work together to bring the business to life. An ideal Team Overview section makes the case not only that your team is the right team for the job, but that you’re the only team for the job.

In order to do this, you need to create a bio for each member of the team. Each team bio should include: the team member’s name; their title and position at the company; their professional background; any special skills they have developed as a result of their past experience; their role and responsibilities at your company; and what makes them uniquely qualified to take that role on.

Pro Tip: This is not the time or place for cheesy fun facts or hobbies. Aim for three to five concise sentences on each team member.

4. Market Opportunity

Before you do a deep dive into what your company does, it’s important to set the stage and provide readers with some insight about why you’re starting this company in the first place. A good market opportunity section addresses two key points: The problem that your product/service solves, and the industry trends that make now the time for your company to succeed.

When writing the “problem” part of this section, consider two questions: What problems do your target customers face that your product/service solves? What annoyances or inconveniences do they face that your company helps to eliminate?

When writing the “trends” section, consider these three questions: What recent emerging trends have you developed your product/service in response to? Are there any new or emerging technologies that make your product/solution possible? Are there any specific brands you can point to that illustrate the demand for products/services like (but not too like) yours?

And to sum it all up, write a conclusion that answer this question: How do the problems customers face and the trends that are happening come together to create the perfect environment for your company to succeed?

5. Company Synopsis

The company synopsis section is where you introduce readers to your company and what you have to offer. This is the easy part: It’s where you get to talk about what you’re doing and why it’s awesome.

Consider these questions if you’re having trouble getting started: What does your company do? How does it solve the problem you’ve previously outlined? What products and services do you offer? How will customers use your product/service? What are the key features? What makes your product/service different from anything currently available?

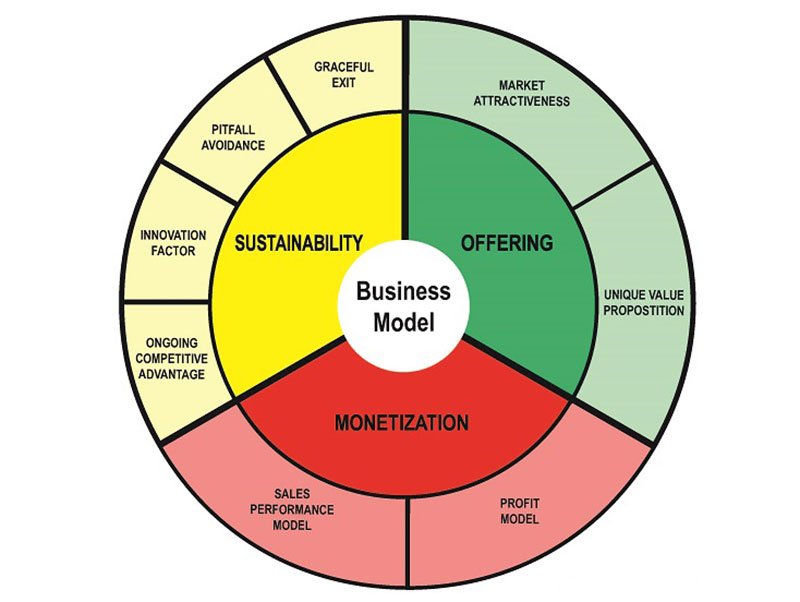

6. Revenue Model

This is where you answer the age-old question of any business: How does your company make money? Identify all current/initial revenue sources, including pricing, COGS, and margins.

Ask yourself: Why is this revenue model the right fit for your current stage? How does your pricing compare to competitors? Are there additional revenue sources you plan to add down the line? If you haven’t started generating revenue when & how will you “flip the switch”?

7. Traction/Company Milestones

It’s important for investors to see that your business is more than just an idea on a cocktail napkin; it’s an actual, viable business. Traction is a huge part of making that case.

Here are some key categories of traction that signal to readers that your company is making moves.

- Product Development : Where are you in the process? Is your product in the market?

- Manufacturing/Distribution: Do you have an established partner for production/manufacturing? Distribution?

- Early Customers and Revenue : Do you have existing customers? How many? And how fast are you growing? Have you started generating revenue?

- Testimonials and Social Proof : Do you have any positive client reviews of your product/service? Any high profile customers or industry experts?

- Partnerships : Have you secured partnerships with any established brands?

- Intellectual Property : Do you have any patents for the technology behind your company? Is your company name trademarked?

- Press Mentions : Has your company been featured by any media outlets? Which ones?

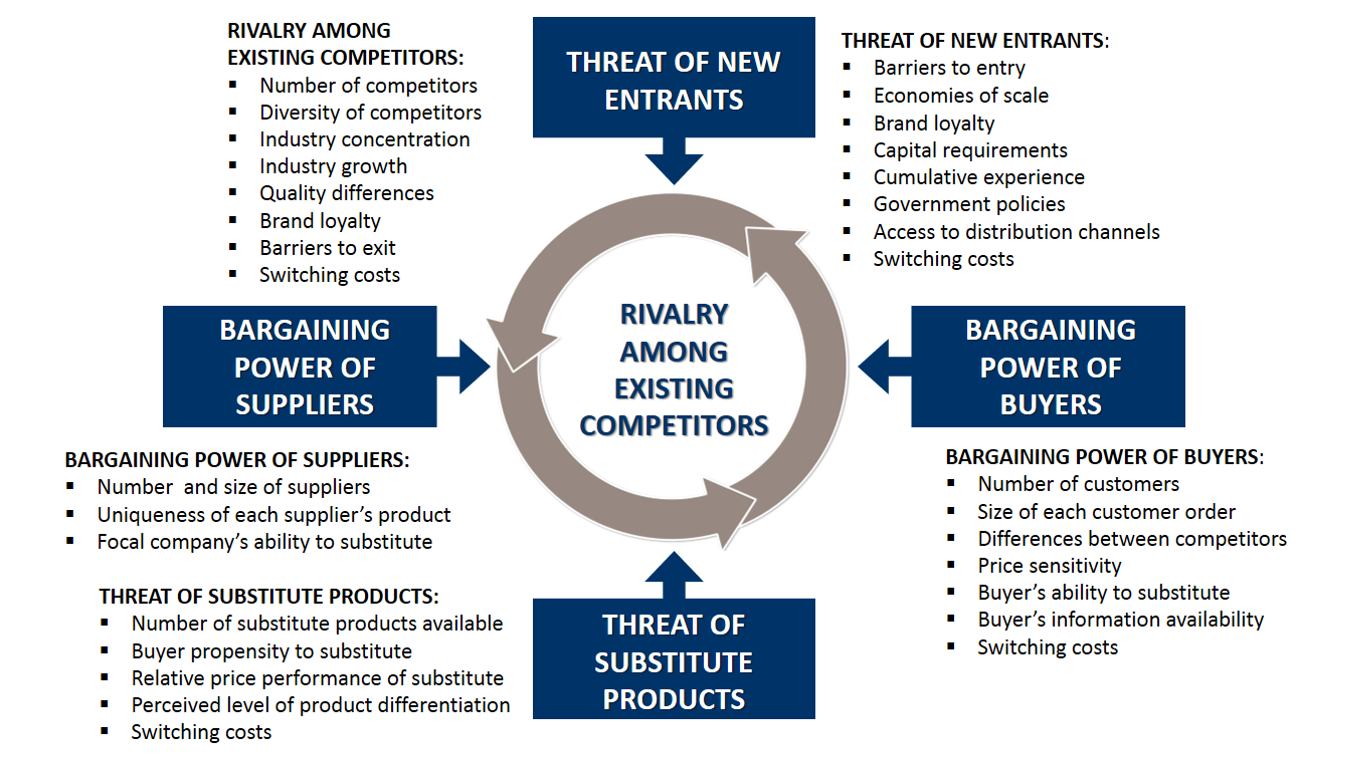

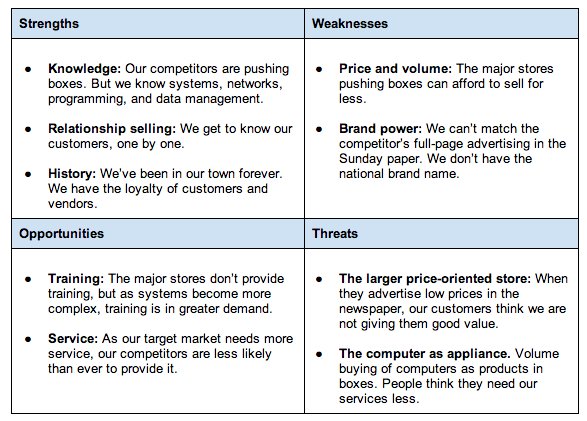

8. Industry Analysis

The industry analysis section provides a bird’s eye view of the industry your company is positioned in, what’s happening in the industry, and where your company stands in relation to your peers. You want readers to walk away from your business plan seeing not only that you’re an expert in your company but that you’re highly knowledgeable about the industry you’re entering into.

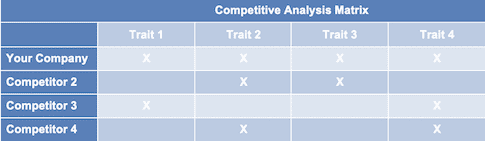

Be intentional about the statistics you include in the plan. Include only numbers that really help to illustrate: the size of the opportunity your company is positioned to address; the demand for your solution; the growth of the audience/demand for your product that is already happening; and competitor analysis.

Now that you’ve introduced readers to your industry, it’s time to give them a glimpse into the other companies that are working in the same space, and how your company stacks up. Identify at least three sources of competition for your company and answer the following questions about each one:

- Basic Info : Where are they based? What stage of growth are they in?

- Traction : How much revenue do they generate? How many customers do they have? Have they received funding?

- Similarities and Differences : What are their strengths? How do you plan to neutralize them? What are their weaknesses? How is that an advantage to you?

- The Takeaway : What can you learn from your competitors to make your company stronger?

Pro tip: When identifying competitors, it’s important to think outside the box, and look beyond companies that are offering the exact same product or service that you are. A skimpy competitor analysis section doesn’t tell investors that your solution is unrivaled — it tells them that you’re not looking hard enough.

9. Differentiating Factors

The differentiating factors section is where you outline how your product/service is different from others on the market and how those differences will help you to maintain your strategic edge. Ask yourself: What are three to five key differentiators between your company and other solutions out there? How will these advantages translate into a long-term advantage for your company?

10. Target Audience

The target audience section is where you show readers that you know who your audience is, where they are, and what is important to them.

Some questions to help you get started include: Who are the people that your product/service is designed to appeal to? What do you know about customers in this demographic? Does your target audience skew more male or more female? What age range do your target customers fall in? Around how many people are there in this target demographic? Where do your target customers live? How much money do they make? Do they have any particular priorities or concerns when it comes to the products/services they buy?

11. User Acquisition and Marketing Strategy

Now that we know who your customers are, the next question is: How do you plan on getting them?

Ask yourself: How will you get your first customers? Who will you target first? Will you introduce your product in certain key geographic locations? Are there any existing brands that you are planning to partner with? How do you plan to raise awareness for your brand? What forms of media will you use? Why? Do you have a presence on social media? Which platforms do you use and why? Essentially, what is your marketing strategy ?

12. Future Growth and Development

Once you’ve accomplished all the short-term goals, built out your initial product offering, and acquired your first customers — what will you do to grow your business from there?

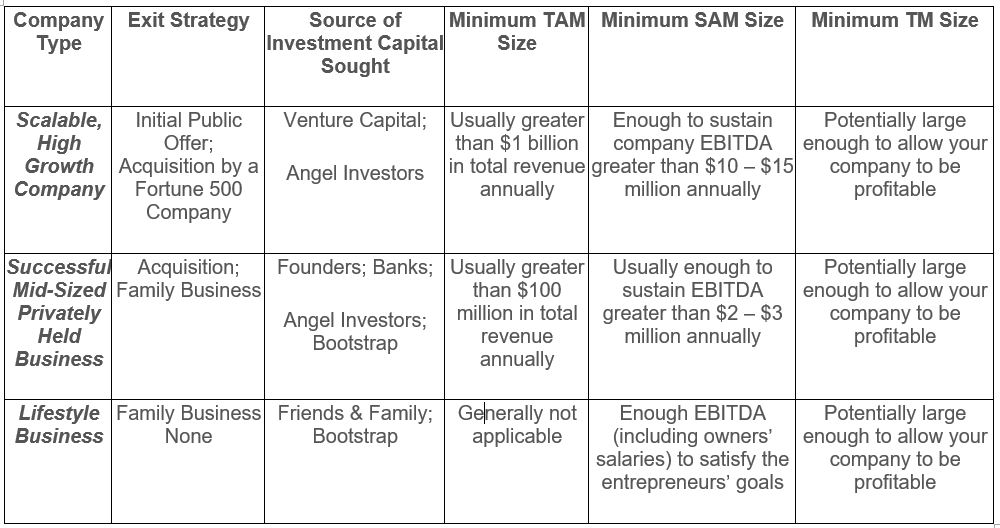

Ask yourself: Do you have any new products in the pipeline? How will these new products enhance your current offerings? Are you planning to expand into new markets (new cities, new demographic categories)? Can you provide a timeline of when you expect each new development to take place? What metrics or conditions will help you to decide when it’s time to move forward? What are some potential exit strategies for your company down the road? Will you seek acquisition by a larger company? Do you plan to take the company public with an Initial Public Offering?

13. Financial Overview

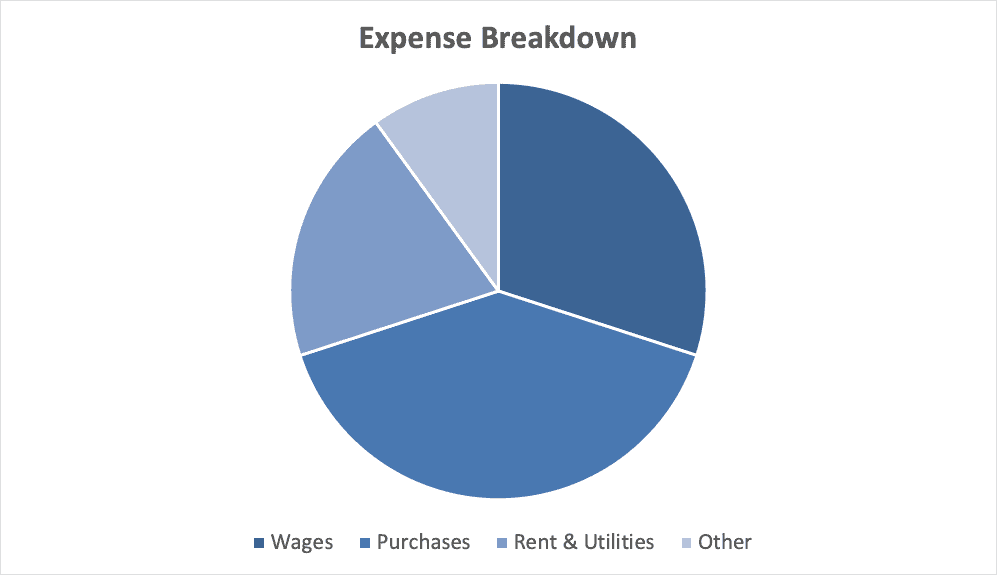

Financial data is always at the end of the business plan, but that doesn’t mean it’s any less important. In fact, poor financials can rip apart anything you initially had going for you. The charts, tables, and formulas in your financial section show an investor how well you’re doing and what your odds are for continued survival.

The three most important things to include are: cash flow statement, income statement, and your balance sheet. While these three things are related, they measure quite different aspects of a company’s financial health.

We’re Here To Help

There you have it: A comprehensive guide to writing your next business plan for investors. Sound like a big undertaking? Our friends at Bizplan.com have your back. Click here for a Startups.co exclusive discount on their services. Good luck!

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Simple Business Plan Template (2024)

Table of Contents

Why business plans are vital, get your free simple business plan template, how to write an effective business plan in 6 steps, frequently asked questions.

While taking many forms and serving many purposes, they all have one thing in common: business plans help you establish your goals and define the means for achieving them. Our simple business plan template covers everything you need to consider when launching a side gig, solo operation or small business. By following this step-by-step process, you might even uncover a few alternate routes to success.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Tailor Brands

$0 + state fee

On Tailor Brands' Website

$0 + State Fee

On Formations' Website

Whether you’re a first-time solopreneur or a seasoned business owner, the planning process challenges you to examine the costs and tasks involved in bringing a product or service to market. The process can also help you spot new income opportunities and hone in on the most profitable business models.

Though vital, business planning doesn’t have to be a chore. Business plans for lean startups and solopreneurs can simply outline the business concept, sales proposition, target customers and sketch out a plan of action to bring the product or service to market. However, if you’re seeking startup funding or partnership opportunities, you’ll need a write a business plan that details market research, operating costs and revenue forecasting. Whichever startup category you fall into, if you’re at square one, our simple business plan template will point you down the right path.

Copy our free simple business plan template so you can fill in the blanks as we explore each element of your business plan. Need help getting your ideas flowing? You’ll also find several startup scenario examples below.

Download free template as .docx

Whether you need a quick-launch overview or an in-depth plan for investors, any business plan should cover the six key elements outlined in our free template and explained below. The main difference in starting a small business versus an investor-funded business is the market research and operational and financial details needed to support the concept.

1. Your Mission or Vision

Start by declaring a “dream statement” for your business. You can call this your executive summary, vision statement or mission. Whatever the name, the first part of your business plan summarizes your idea by answering five questions. Keep it brief, such as an elevator pitch. You’ll expand these answers in the following sections of the simple business plan template.

- What does your business do? Are you selling products, services, information or a combination?

- Where does this happen? Will you conduct business online, in-store, via mobile means or in a specific location or environment?

- Who does your business benefit? Who is your target market and ideal customer for your concept?

- Why would potential customers care? What would make your ideal customers take notice of your business?

- How do your products and/or services outshine the competition? What would make your ideal customers choose you over a competitor?

These answers come easily if you have a solid concept for your business, but don’t worry if you get stuck. Use the rest of your plan template to brainstorm ideas and tactics. You’ll quickly find these answers and possibly new directions as you explore your ideas and options.

2. Offer and Value Proposition

This is where you detail your offer, such as selling products, providing services or both, and why anyone would care. That’s the value proposition. Specifically, you’ll expand on your answers to the first and fourth bullets from your mission/vision.

As you complete this section, you might find that exploring value propositions uncovers marketable business opportunities that you hadn’t yet considered. So spend some time brainstorming the possibilities in this section.

For example, a cottage baker startup specializing in gluten-free or keto-friendly products might be a value proposition that certain audiences care deeply about. Plus, you could expand on that value proposition by offering wedding and other special-occasion cakes that incorporate gluten-free, keto-friendly and traditional cake elements that all guests can enjoy.

3. Audience and Ideal Customer

Here is where you explore bullet point number three, who your business will benefit. Identifying your ideal customer and exploring a broader audience for your goods or services is essential in defining your sales and marketing strategies, plus it helps fine-tune what you offer.

There are many ways to research potential audiences, but a shortcut is to simply identify a problem that people have that your product or service can solve. If you start from the position of being a problem solver, it’s easy to define your audience and describe the wants and needs of your ideal customer for marketing efforts.

Using the cottage baker startup example, a problem people might have is finding fresh-baked gluten-free or keto-friendly sweets. Examining the wants and needs of these people might reveal a target audience that is health-conscious or possibly dealing with health issues and willing to spend more for hard-to-find items.

However, it’s essential to have a customer base that can support your business. You can be too specialized. For example, our baker startup can attract a broader audience and boost revenue by offering a wider selection of traditional baked goods alongside its gluten-free and keto-focused specialties.

4. Revenue Streams, Sales Channels and Marketing

Thanks to our internet-driven economy, startups have many revenue opportunities and can connect with target audiences through various channels. Revenue streams and sales channels also serve as marketing vehicles, so you can cover all three in this section.

Revenue Streams

Revenue streams are the many ways you can make money in your business. In your plan template, list how you’ll make money upon launch, plus include ideas for future expansion. The income possibilities just might surprise you.

For example, our cottage baker startup might consider these revenue streams:

- Product sales : Online, pop-up shops , wholesale and (future) in-store sales

- Affiliate income : Monetize blog and social media posts with affiliate links

- Advertising income : Reserve website space for advertising

- E-book sales : (future) Publish recipe e-books targeting gluten-free and keto-friendly dessert niches

- Video income : (future) Monetize a YouTube channel featuring how-to videos for the gluten-free and keto-friendly dessert niches

- Webinars and online classes : (future) Monetize coaching-style webinars and online classes covering specialty baking tips and techniques

- Members-only content : (future) Monetize a members-only section of the website for specialty content to complement webinars and online classes

- Franchise : (future) Monetize a specialty cottage bakery concept and sell to franchise entrepreneurs

Sales Channels

Sales channels put your revenue streams into action. This section also answers the “where will this happen” question in the second bullet of your vision.

The product sales channels for our cottage bakery example can include:

- Mobile point-of-sale (POS) : A mobile platform such as Shopify or Square POS for managing in-person sales at local farmers’ markets, fairs and festivals

- E-commerce platform : An online store such as Shopify, Square or WooCommerce for online retail sales and wholesale sales orders

- Social media channels : Facebook, Instagram and Pinterest shoppable posts and pins for online sales via social media channels

- Brick-and-mortar location : For in-store sales , once the business has grown to a point that it can support a physical location

Channels that support other income streams might include:

- Affiliate income : Blog section on the e-commerce website and affiliate partner accounts

- Advertising income : Reserved advertising spaces on the e-commerce website

- E-book sales : Amazon e-book sales via Amazon Kindle Direct Publishing

- Video income : YouTube channel with ad monetization

- Webinars and online classes : Online class and webinar platforms that support member accounts, recordings and playback

- Members-only content : Password-protected website content using membership apps such as MemberPress

Nowadays, the line between marketing and sales channels is blurred. Social media outlets, e-books, websites, blogs and videos serve as both marketing tools and income opportunities. Since most are free and those with advertising options are extremely economical, these are ideal marketing outlets for lean startups.

However, many businesses still find value in traditional advertising such as local radio, television, direct mail, newspapers and magazines. You can include these advertising costs in your simple business plan template to help build a marketing plan and budget.

5. Structure, Suppliers and Operations

This section of your simple business plan template explores how to structure and operate your business. Details include the type of business organization your startup will take, roles and responsibilities, supplier logistics and day-to-day operations. Also, include any certifications or permits needed to launch your enterprise in this section.

Our cottage baker example might use a structure and startup plan such as this:

- Business structure : Sole proprietorship with a “doing business as” (DBA) .

- Permits and certifications : County-issued food handling permit and state cottage food certification for home-based food production. Option, check into certified commercial kitchen rentals.

- Roles and responsibilities : Solopreneur, all roles and responsibilities with the owner.

- Supply chain : Bulk ingredients and food packaging via Sam’s Club, Costco, Amazon Prime with annual membership costs. Uline for shipping supplies; no membership needed.

- Day-to-day operations : Source ingredients and bake three days per week to fulfill local and online orders. Reserve time for specialty sales, wholesale partner orders and market events as needed. Ship online orders on alternating days. Update website and create marketing and affiliate blog posts on non-shipping days.

Start A Limited Liability Company Online Today with ZenBusiness

Click to get started.

6. Financial Forecasts

Your final task is to list forecasted business startup and ongoing costs and profit projections in your simple business plan template. Thanks to free business tools such as Square and free marketing on social media, lean startups can launch with few upfront costs. In many cases, cost of goods, shipping and packaging, business permits and printing for business cards are your only out-of-pocket expenses.

Cost Forecast

Our cottage baker’s forecasted lean startup costs might include:

Gross Profit Projections

This helps you determine the retail prices and sales volume required to keep your business running and, hopefully, earn income for yourself. Use product research to spot target retail prices for your goods, then subtract your cost of goods, such as hourly rate, raw goods and supplier costs. The total amount is your gross profit per item or service.

Here are some examples of projected gross profits for our cottage baker:

Bottom Line

Putting careful thought and detail in a business plan is always beneficial, but don’t get so bogged down in planning that you never hit the start button to launch your business . Also, remember that business plans aren’t set in stone. Markets, audiences and technologies change, and so will your goals and means of achieving them. Think of your business plan as a living document and regularly revisit, expand and restructure it as market opportunities and business growth demand.

Is there a template for a business plan?

You can copy our free business plan template and fill in the blanks or customize it in Google Docs, Microsoft Word or another word processing app. This free business plan template includes the six key elements that any entrepreneur needs to consider when launching a new business.

What does a simple business plan include?

A simple business plan is a one- to two-page overview covering six key elements that any budding entrepreneur needs to consider when launching a startup. These include your vision or mission, product or service offering, target audience, revenue streams and sales channels, structure and operations, and financial forecasts.

How can I create a free business plan template?

Start with our free business plan template that covers the six essential elements of a startup. Once downloaded, you can edit this document in Google Docs or another word processing app and add new sections or subsections to your plan template to meet your specific business plan needs.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best LLC Services

- Best Registered Agent Services

- Best Trademark Registration Services

- Top LegalZoom Competitors

- Best Business Loans

- Best Business Plan Software

- ZenBusiness Review

- LegalZoom LLC Review

- Northwest Registered Agent Review

- Rocket Lawyer Review

- Inc. Authority Review

- Rocket Lawyer vs. LegalZoom

- Bizee Review (Formerly Incfile)

- Swyft Filings Review

- Harbor Compliance Review

- Sole Proprietorship vs. LLC

- LLC vs. Corporation

- LLC vs. S Corp

- LLP vs. LLC

- DBA vs. LLC

- LegalZoom vs. Incfile

- LegalZoom vs. ZenBusiness

- LegalZoom vs. Rocket Lawyer

- ZenBusiness vs. Incfile

- How To Start A Business

- How to Set Up an LLC

- How to Get a Business License

- LLC Operating Agreement Template

- 501(c)(3) Application Guide

- What is a Business License?

- What is an LLC?

- What is an S Corp?

- What is a C Corp?

- What is a DBA?

- What is a Sole Proprietorship?

- What is a Registered Agent?

- How to Dissolve an LLC

- How to File a DBA

- What Are Articles Of Incorporation?

- Types Of Business Ownership

Next Up In Company Formation

- Best Online Legal Services

- How To Write A Business Plan

- Member-Managed LLC Vs. Manager-Managed LLC

- Starting An S-Corp

- LLC Vs. C-Corp

- How Much Does It Cost To Start An LLC?

How to Start a Business (2024 Guide)

5 Best Social Media Management Tools In 2024

Best Receipt Scanner Apps Of 2024

8 Best Cheap VPS Hosting Services Of 2024

Best Ohio LLC Services In 2024

Best Oregon LLC Services In 2024

Krista Fabregas is a seasoned eCommerce and online content pro sharing more than 20 years of hands-on know-how with those looking to launch and grow tech-forward businesses. Her expertise includes eCommerce startups and growth, SMB operations and logistics, website platforms, payment systems, side-gig and affiliate income, and multichannel marketing. Krista holds a bachelor's degree in English from The University of Texas at Austin and held senior positions at NASA, a Fortune 100 company, and several online startups.

🌍 Upmetrics is now available in

- Sample Business Plans

- Finance & Investing

Investment Company Business Plan

The possibility for substantial financial gains is one of the main advantages of an investment company. As the company expands and gains customers, it has the potential to generate large fees and commissions based on investment portfolios.

Are you looking for the same rewards? Then go on with planning everything first.

Need help writing a business plan for your investment company? You’re at the right place. Our investment company business plan template will help you get started.

Free Business Plan Template

Download our free investment company business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write An Investment Company Business Plan?

Writing an investment company business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

- Introduce your Business: Start your executive summary by briefly introducing your business to your readers.This section may include the name of your investment company, its location, when it was founded, the type of investment company (E.g., mutual fund companies, hedge funds, venture capital firms), etc.

- Market Opportunity: Summarize your market research, including market size, growth potential, and marketing trends. Highlight the opportunities in the market and how your business will fit in to fill the gap.

- Products and Services: Highlight the investment company services you offer your clients. The USPs and differentiators you offer are always a plus.For instance, you may include investment management, portfolio diversification, or tax planning as services and mention customized investment solutions as your USP.

- Marketing & Sales Strategies: Outline your sales and marketing strategies—what marketing platforms you use, how you plan on acquiring customers, etc.

- Financial Highlights: Briefly summarize your financial projections for the initial years of business operations. Include any capital or investment requirements, associated startup costs, projected revenues, and profit forecasts.

- Call to Action: Summarize your executive summary section with a clear CTA, for example, inviting angel investors to discuss the potential business investment.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

- Mutual fund companies

- Venture capital funds

- Private equity funds

- Asset management companies

- Pension fund managers

- Describe the legal structure of your investment company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

- Owners: List the names of your investment company’s founders or owners. Describe what shares they own and their responsibilities for efficiently managing the business. Mission Statement: Summarize your business’ objective, core principles, and values in your mission statement. This statement needs to be memorable, clear, and brief.

- Business History: If you’re an established investment company, briefly describe your business history, like—when it was founded, how it evolved over time, etc.Additionally, If you have received any awards or recognition for excellent work, describe them.

- Future Goals: It’s crucial to convey your aspirations and vision. Mention your short-term and long-term goals; they can be specific targets for revenue, market share, or expanding your services.

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

- Target market: Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.For instance, individual individuals, institutions & corporations, etc can be the target market for investment companies.

- Market size and growth potential: Describe your market size and growth potential and whether you will target a niche or a much broader market.The global investment market grew to around $3837 billion this year from around $3532 billion in 2022 at a CAGR of 8.6%.

- Competitive Analysis: Identify and analyze your direct and indirect competitors. Identify their strengths and weaknesses, and describe what differentiates your investment company services from them. Point out how you have a competitive edge in the market.

- Market Trends: Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.For instance, there is growing popularity for passive income; explain how you plan on dealing with this potential growth opportunity.

- Regulatory Environment: List regulations and licensing requirements that may affect your investment company, such as securities laws, anti-money laundering laws, KYC, market regulations, etc.

Here are a few tips for writing the market analysis section of your investment company business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

- Portfolio management

- Financial planning

- Investment research and analysis

- Wealth management

- Mutual funds and exchange-traded funds

- Investment advisory services: Investment advisory services might include professional advice on asset allocation, investment strategies, and portfolio construction. Both discretionary and non-discretionary investment advisory services available or not should be mentioned.

- Additional Services: Mention if your investment company offers any additional services. You may include services like retirement planning, estate planning & wealth transfer, business succession planning, etc.

In short, this section of your investment business plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

- Unique Selling Proposition (USP): Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.For example, customized investment solutions, expertise, or innovative investment strategies could be some of the great USPs for an investment company.

- Pricing Strategy: Describe your pricing strategy—how you plan to price your services and stay competitive in the local market. You can mention any discounts you plan on offering to attract new customers.

- Marketing Strategies: Discuss your marketing strategies to market your services. You may include some of these marketing strategies in your business plan—social media marketing, Google ads, SEO, email marketing, content marketing, etc.

- Sales Strategies: Outline the strategies you’ll implement to maximize your sales. Your sales strategies may include direct sales calls, partnering with other businesses, consultative selling, etc.

- Customer Retention: Describe your customer retention strategies and how you plan to execute them. For instance, introducing loyalty programs, discounts on annual membership, personalized service, etc.

Overall, this section of your investment company business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your investment business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

- Staffing & Training: Mention your business’s staffing requirements, including the number of employees, consultants, or data analyst needed. Include their qualifications, the training required, and the duties they will perform.

- Operational Process: Outline the processes and procedures you will use to run your investment company. Your operational processes may include portfolio management, client onboarding, investment research & analysis, trade execution & settlement, etc.

- Equipment & Software: Include the list of equipment and software required for investment business, such as servers & data storage, network equipment, trading platforms, customer relationship management software, portfolio management software, etc.Explain how these technologies help you maintain quality standards and improve the efficiency of your business operations.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your investment business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

- Founders/CEO: Mention the founders and CEO of your investment company, and describe their roles and responsibilities in successfully running the business.

- Key managers: Introduce your management and key members of your team, and explain their roles and responsibilities.It should include, key executives(e.g. COO, CMO), senior management, and other department managers (e.g. operations manager, portfolio manager, compliance manager) involved in the investment company business operations, including their education, professional background, and any relevant experience in the industry.

- Organizational structure: Explain the organizational structure of your management team. Include the reporting line and decision-making hierarchy.

- Compensation Plan: Describe your compensation plan for the management and staff. Include their salaries, incentives, and other benefits.

- Advisors/Consultants: Mentioning advisors or consultants in your business plans adds credibility to your business idea.So, if you have any advisors or consultants, include them with their names and brief information consisting of roles and years of experience.

This section should describe the key personnel for your investment company, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

- Profit & loss statement: Describe details such as projected revenue, operational costs, and service costs in your projected profit and loss statement . Make sure to include your business’s expected net profit or loss.

- Cash flow statement: The cash flow for the first few years of your operation should be estimated and described in this section. This may include billing invoices, payment receipts, loan payments, and any other cash flow statements.

- Balance Sheet: Create a projected balance sheet documenting your investment company’s assets, liabilities, and equity.

- Break-even point: Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

- Financing Needs: Calculate costs associated with starting an investment company, and estimate your financing needs and how much capital you need to raise to operate your business. Be specific about your short-term and long-term financing requirements, such as investment capital or loans.

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your investment firm business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample investment company business plan will provide an idea for writing a successful investment company plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our investment company business plan pdf .

Related Posts

Bookkeeping Business Plan

Concierge Services Business Plan

How to make Perfect Business Outline

Simple Business Plan Template Example

What are Business Plan Components

How to Write a Business Plan For Investors

Frequently Asked Questions

Why do you need an investment company business plan.

A business plan is an essential tool for anyone looking to start or run a successful investment business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your investment company.

How to get funding for your investment company?

There are several ways to get funding for your investment company, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your investment company?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your investment company business plan and outline your vision as you have in your mind.

What is the easiest way to write your investment company business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any investment company business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Writing an Investor-Ready Business Plan

- Fundrising Ready

- MAC & PC Compatible

- Immediate Download

Related Blogs

- Understanding Financial Planning and Analysis - What, Why, and How

- Preparing a Pitch Deck

- Developing strategies to achieve your business goals

- Unlock Your Business Potential with Market Research

- What is the Difference Between a Pre-Seed and a Seed Fundraising Round?

Crafting an investor-ready business plan is a pivotal step for entrepreneurs aiming to secure funding and propel their ventures forward. This comprehensive document not only outlines your business's vision but also delves into critical components such as market analysis , financial projections , and a persuasive value proposition . By mastering these essential elements, you can capture the attention of potential investors and set the stage for success.

What are the essential components of an investor-ready business plan?

Executive summary.

The executive summary is the first thing investors will read, and it should succinctly convey the essence of your business idea. This section serves as a snapshot of your entire business plan, highlighting key elements such as your mission statement, the problem you aim to solve, and your proposed solution. An effective executive summary should not exceed two pages and must captivate the reader’s interest immediately.

Market Analysis

A comprehensive market analysis is crucial for an investor-ready business plan. This section must include:

- Target Market Demographics: Define who your customers are, including age, gender, income level, and preferences.

- Market Size Analysis: Estimate the size of your target market and growth potential.

- Market Research Techniques: Utilize surveys, focus groups, and industry reports to gather relevant data.

- Competitive Advantage Analysis: Identify your competitors and analyze their strengths and weaknesses.

Providing solid data and insights will help investors understand your market position and potential for growth.

Business Model and Revenue Projections

The business model outlines how your business intends to make money. It should explain your product or service offerings and pricing strategy. In addition, include detailed revenue projections, such as:

- Sales forecasts based on customer acquisition strategies.

- Pricing models and expected profit margins.

- Projected customer retention rates.

Investors will look for realistic financial projections that demonstrate a clear path to profitability.

Marketing and Sales Strategy

Your marketing and sales strategy should detail how you plan to attract and retain customers. This section should cover:

- Effective Marketing Strategy: Outline your marketing channels, including digital marketing, social media, and traditional marketing methods.

- Customer Acquisition Strategy: Describe tactics for acquiring new customers and achieving sales targets.

- Marketing Budget Allocation: Provide a budget for your marketing initiatives and expected ROI.

Clearly articulating your strategy will assure investors that you have a solid plan for generating sales and building brand awareness.

Financial Projections and Funding Requirements

This section is critical for investors as it provides an overview of your financial health and future needs. Include:

- Profit and Loss Forecast Examples: Present a three to five-year profit and loss forecast, detailing expected revenues and expenses.

- Cash Flow Statements: Project cash inflows and outflows to demonstrate financial viability.

- Break-even Analysis: Indicate when your business will become profitable.

- Business Funding Requirements: Clearly state how much capital you need and how you plan to use it.

Investors will expect you to provide financial projections for investors that are realistic and backed by thorough research.

- Keep your executive summary concise and impactful to grab attention.

- Use visuals where appropriate to enhance your market analysis.

- Regularly update your financial projections based on new data and trends.

How do you define your business's value proposition?

Identifying unique selling points.

To successfully create an investor-ready business plan, start by identifying your unique selling points (USPs) . These are the specific features or benefits that distinguish your product or service from competitors. Consider what makes your offering special:

- Is it a new technology or a unique feature?

- Does it solve a specific problem more effectively than alternatives?

- Is it priced more competitively?

Highlighting these USPs in your business plan presentation can capture the attention of potential investors and demonstrate why your venture is worth funding.

Analyzing competitive advantages

Next, conduct a competitive advantage analysis . Understand where you stand in the market landscape. This involves:

- Researching your competitors and their offerings

- Identifying gaps in their services that you can fill

- Analyzing your operational strengths, such as superior customer service, innovative processes, or strategic partnerships

Articulating these advantages in your investor-ready business plan will help investors see the long-term viability of your business model.

Understanding customer pain points

Understanding your target market's pain points is crucial for defining your value proposition. These pain points are the specific issues or challenges your customers face that your product or service can address. To gain insights:

- Engage in direct conversations with potential customers to gather feedback.

- Utilize market research for business plan development to identify common frustrations.

- Analyze online reviews and feedback on similar products.

By addressing these pain points in your business plan, you can effectively align your offerings with market needs, increasing your appeal to investors.

Crafting a compelling narrative

A compelling narrative is essential for your investor pitch deck. This narrative should weave together your USPs, competitive advantages, and customer pain points into a coherent story that resonates with your audience. Consider these elements:

- Start with the problem: clearly articulate the market need.

- Introduce your solution: describe how your product or service addresses this need.

- Highlight success stories or testimonials to build credibility.

Crafting a well-defined narrative will not only help investors understand the value your business brings but also engage them emotionally.

Aligning value with market needs

Finally, ensure that your value proposition aligns with the current market needs and trends. Conduct thorough market analysis techniques to:

- Identify the size and dynamics of your target market demographics.

- Evaluate industry trends that may affect your business model and revenue projections.

- Adjust your offerings based on emerging consumer preferences or technological advancements.

By aligning your value proposition with market needs, you enhance the likelihood of investor interest and support for your business.

- Regularly revisit and refine your value proposition as market conditions change to remain relevant.

- Utilize surveys or focus groups to gain deeper insights into customer perceptions and pain points.

- Consider developing a prototype or minimum viable product (MVP) to showcase your solution during investor meetings.

What market research is necessary to support your business plan?

Identifying target demographics.

Understanding your target market demographics is crucial for crafting an effective marketing strategy. This includes identifying the age, gender, income level, education, and geographic location of your potential customers. By honing in on these characteristics, you can tailor your messaging and product offerings to meet the specific needs of your audience.

Evaluating industry trends

Conducting a thorough evaluation of industry trends will provide insight into the current market landscape and future opportunities. Analyzing trends helps you anticipate shifts in consumer behavior and adapt your business model accordingly. Utilize resources such as industry reports, articles, and expert interviews to gather relevant data.

Assessing competitor analysis

Performing a competitive advantage analysis is essential to understand how your business stacks up against others in the market. Identify your direct competitors and analyze their strengths, weaknesses, pricing strategies, and customer reviews. This analysis will help you identify gaps in the market that your business can exploit, as well as potential threats to your success.

Gathering customer feedback

Collecting customer feedback is invaluable for validating your business concept and refining your offerings. Engage with potential customers through surveys, interviews, and focus groups to gain insights into their preferences and pain points. This direct input can inform your value proposition definition and help you create products or services that resonate with your audience.

Quantifying market size and growth potential

To attract business funding requirements , it’s essential to quantify the market size and growth potential. Use market size analysis techniques to estimate the total addressable market (TAM) for your product or service. Consider factors such as current market demand, projected growth rates, and economic conditions that may impact your industry. This data will be crucial for your financial projections for investors.

- Utilize online tools and databases to gather demographic and industry data efficiently.

- Regularly review and update your market research to stay current with evolving trends.

- Engage with industry experts to gain deeper insights into market dynamics.

How should you outline your marketing and sales strategy?

Defining marketing channels.

Identifying the right marketing channels is crucial for reaching your target audience effectively. This involves exploring various platforms and methods to promote your product or service. Consider the following channels:

- Social media platforms (e.g., Facebook, Instagram, LinkedIn)

- Email marketing

- Content marketing (blogs, videos, podcasts)

- Search engine optimization (SEO)

- Pay-per-click advertising (Google Ads, social media ads)

- Traditional media (print ads, radio, TV)

Evaluate where your target market demographics spend their time and tailor your approach accordingly to ensure optimal engagement.

Setting sales goals and KPIs

Establishing clear sales goals and key performance indicators (KPIs) is essential for measuring your marketing success. SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) are a great framework to follow. Examples of sales goals include:

- Increasing monthly sales by 20% within six months

- Acquiring 100 new customers by the end of the quarter

- Improving customer retention rates by 15% over the next year

KPIs should be aligned with these goals, allowing you to track progress and make informed adjustments to your strategy.

Detailing customer acquisition tactics

Your customer acquisition strategy should be comprehensive, outlining how you plan to attract and convert potential customers. Consider the following tactics:

- Creating targeted advertising campaigns

- Implementing referral programs

- Utilizing influencer marketing

- Offering promotions and discounts

- Engaging in public relations efforts

Documenting these tactics in your investor-ready business plan will demonstrate your proactive approach to generating revenue.

Crafting a customer retention plan

Acquiring customers is only part of the equation; retaining them is equally important. A successful customer retention plan includes strategies to keep customers engaged and satisfied. Some effective strategies are:

- Implementing loyalty programs

- Providing exceptional customer service

- Regularly soliciting customer feedback

- Offering personalized experiences

- Communicating consistently through newsletters and updates

By focusing on retention, you can enhance customer lifetime value and reduce churn rates, ultimately improving your financial projections for investors.

- Regularly review and adjust your marketing budget allocation based on performance metrics to optimize spending.

- Utilize market research for business plan components to stay informed about changing customer preferences and industry trends.

Budgeting for marketing initiatives

Creating a detailed budget for your marketing initiatives is vital for controlling costs and maximizing return on investment. Consider the following when budgeting:

- Determine your overall marketing budget as a percentage of projected revenue.

- Allocate funds across various marketing channels according to their effectiveness.

- Include costs for tools and software that will enhance your marketing efforts.

- Factor in potential unexpected expenses and set aside a contingency fund.

A well-planned marketing budget will not only guide your spending but also demonstrate to investors that you have a solid understanding of your business funding requirements.

What financial projections should be included in the business plan?

Three to five-year profit and loss forecast.

A profit and loss forecast is a crucial component of an investor-ready business plan. This projection outlines expected revenues and expenses over a three to five-year period, enabling potential investors to gauge the viability and profitability of your business model. It should include:

- Revenue streams from various products or services

- Fixed and variable costs associated with running the business

- Net profit margins and overall profitability

Make sure to base your profit and loss projections on realistic assumptions derived from market research for business plan and historical data, if available.

Cash flow statements

Cash flow statements provide insights into the liquidity of your business. They detail the inflows and outflows of cash, helping to assess whether the company can meet its short-term obligations. The cash flow statement should include:

- Operating activities, such as cash received from customers and cash paid to suppliers

- Investing activities, like purchases of equipment or investments

- Financing activities, including loans taken and repayments made

Accurate cash flow projections are crucial for managing your business funding requirements effectively.

Balance sheet projections

Balance sheet projections reflect the financial position of your business at a specific point in time, showing assets, liabilities, and equity. Essential elements include:

- Current and long-term assets, such as cash, inventory, and property

- Liabilities, including accounts payable and long-term debts

- Shareholder equity, showing the net worth of the company

This projection helps investors understand the overall financial health and stability of your business.

Break-even analysis

A break-even analysis is essential for determining when your business will start to generate profit. It calculates the sales volume at which total revenues equal total costs. Key components of this analysis include:

- Fixed costs, which remain constant regardless of sales

- Variable costs, which fluctuate with production volume

- Sales price per unit and the contribution margin

This analysis is particularly useful in convincing investors of the potential for profitability within a realistic timeframe.

Sensitivity analysis for different scenarios

Sensitivity analysis tests how changes in key variables can impact your financial projections. It allows you to present various scenarios—such as best case, worst case, and most likely case—demonstrating the robustness of your business model and revenue projections . Consider factors like:

- Changes in market demand

- Fluctuations in costs

- Variations in pricing strategies

This analysis not only prepares you for potential challenges but also instills confidence in investors regarding your ability to navigate uncertainties.

- Ensure your financial projections are backed by thorough market analysis techniques and realistic assumptions.

- Regularly update financial forecasts to reflect changes in the business environment or market conditions.

- Utilize software tools for financial modeling to improve accuracy and professionalism in presentations.

How can you effectively present your business plan to investors?

Structuring the presentation for clarity.

When presenting your investor-ready business plan, a clear structure is paramount. Begin with an engaging executive summary that encapsulates the essence of your business. Follow this with sections dedicated to market analysis, business model and revenue projections, and your marketing strategy. Each section should logically flow into the next, guiding potential investors through your plan in a coherent manner.

Utilizing visual aids and data visualizations

Visual aids can significantly enhance your presentation, making complex information more accessible. Utilize charts, graphs, and infographics to illustrate key points, such as market size analysis and financial projections for investors. These visuals not only capture attention but also help convey your message more effectively, allowing investors to grasp your business model and competitive advantage analysis at a glance.

Practicing your pitch delivery

Effective delivery can make or break your presentation. Practice your pitch multiple times, focusing on your tone, pace, and body language. Rehearsing will help you convey confidence and passion for your business. Consider recording yourself or presenting in front of a small audience to receive constructive feedback. This preparation ensures you can articulate your value proposition definition with clarity and conviction.

Anticipating and preparing for questions

Investors will likely have questions about various aspects of your business plan. Anticipate these inquiries by reviewing common investor concerns, such as your customer acquisition strategy and financial forecasting for startups and investors. Prepare thorough responses and consider creating a FAQ section in your presentation to address potential queries proactively.

Highlighting key metrics and milestones

Throughout your presentation, emphasize key metrics and milestones that demonstrate your business's potential for success. Highlight critical elements such as:

- Projected revenue growth over the next three to five years

- Customer retention strategies and their expected impact

- Market research for business plan insights, including target market demographics

- Key partnerships or contracts that validate your business model

These metrics not only showcase your understanding of the business landscape but also provide tangible evidence to support your claims, making your presentation more compelling.

- Keep your slides concise. Aim for a maximum of six bullet points per slide to maintain focus.

- Engage with your audience. Encourage questions during or after your presentation to foster dialogue.

- Utilize storytelling techniques to make your presentation memorable. Share personal anecdotes or case studies that relate to your business.

What common mistakes should you avoid in your business plan?

Lack of clarity and focus.

One of the most detrimental mistakes in crafting an investor-ready business plan is a lack of clarity and focus. Investors need to easily understand your business model and how it aligns with your market goals. If your business plan components are muddled or overly complicated, it can lead to confusion and disinterest.

To avoid this pitfall:

- Use straightforward language and keep your sentences concise.

- Clearly define your value proposition definition and ensure it resonates throughout the document.

Overly optimistic financial projections

While it’s essential to present a positive outlook, overly optimistic financial projections can undermine your credibility. Investors are wary of inflated numbers that are not backed by realistic assumptions. Instead, provide financial projections for investors that reflect achievable goals based on thorough market research for business plan.

To mitigate this risk:

- Base your financial forecasts on historical data and realistic market size analysis.

- Include a range of scenarios in your profit and loss forecast examples to show potential variance.

Ignoring competition and market threats

Another common mistake is failing to conduct a thorough competitive advantage analysis. Investors want to know how you plan to position your business in the market and what threats you might face. Ignoring these factors can lead to a lack of confidence in your business plan.

To address this issue:

- Conduct a detailed competitor analysis to identify your market position.

- Discuss how your effective marketing strategy will differentiate your offering from competitors.

Failing to address potential risks and challenges

Investors appreciate transparency. Failing to acknowledge potential risks and challenges in your investor pitch deck can raise red flags. A well-rounded business plan should include a risk assessment that considers various scenarios.

To effectively tackle this challenge:

- Outline possible risks related to market fluctuations, operational challenges, or financial constraints.

- Present strategies for mitigating these risks, reinforcing your preparedness.

Neglecting to update and revise the plan regularly

Your business plan is a living document, and neglecting to update it regularly can lead to outdated information that can mislead investors. Regular revisions are crucial, especially as you gather new data from ongoing market research or as your business evolves.

To keep your plan relevant:

- Schedule periodic reviews of your business plan components to ensure accuracy.

- Adjust your financial projections for investors based on the latest market trends and performance metrics.

- Choosing a selection results in a full page refresh.

Investment Company Business Plan Template

Written by Dave Lavinsky

Investment Company Business Plan

Over the past 20+ years, we have helped over 1,000 entrepreneurs and business owners create business plans to start and grow their investment companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through an investment company business plan template step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is an Investment Company Business Plan?

A business plan provides a snapshot of your investment company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for an Investment Company

If you’re looking to start an investment company, or grow your existing investment company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your investment company in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Investment Companies

With regards to funding, the main sources of funding for an investment company are bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Investors, grants, personal investments, and bank loans are the most common funding paths for investment companies.